Recent Projects

Kodiak Lake Adult Living

Basalt, CO

RCP invested approximately $11.5 million of equity into the ground-up development of 72 luxury residential rental units designed for Active Adult living (Ages 55+) and 2,600 square feet of ground-floor restaurant space near Aspen, Colorado.

The project will be the closest 55+ Active Adult community to Aspen. Of the five other communities in the competitive market that provide senior housing units, all are much farther from Aspen/Snowmass than the project. The nearest comparable project (Sopris Lodge in Carbondale) opened in July 2021, and its comparable units are 100% occupied with a waitlist.

The Developer, Realty Capital, has an outstanding track record in the Aspen area, as the largest residential developer in the Roaring Fork Valley over the last 10 years.

Wyndham Apartments

Dallas, TX

RCP invested $7 million of equity capital into the value-add acquisition of a 151-unit apartment complex in between the Town Creek and Lake Highlands sub-markets in northeast Dallas.

The project consists of 151-units, compromised of one and two bedroom apartments. Upon acquisition, the property will undergo a staggered cosmetic renovation to accommodate maximum tenant occupancy during the projected 21-month renovation period. The project’s renovation amenity package will include a clubhouse, swimming pool and storage space.

The sponsor, WindMass Capital, owns 3000+ units within a 1-mile radius of the project. The property will transition management to Indio Management, a company that successfully manages several other properties nearby.

Oklahoma Seniors Housing Portfolio

Tulsa and Oklahoma City, OK

RCP invested approximately $11 million of equity to acquire and renovate three private pay, memory care communities in Oklahoma City and Tulsa (the “Portfolio”). The properties are located in desirable residential areas with upper income households and strong seniors’ populations.

Matteo Realty Partners, the Sponsor and Operator, has a successful track record with RCP. RCP’s investors received an average 20.6% internal rate of return (“IRR”) and 2.1x multiple with three previous Sponsor investments.

The Sponsor will execute its business plan of acquiring the portfolio at a low cost basis, conducting a renovation focused on cosmetic improvements, and reducing operating inefficiencies by implementing Iris Memory Care’s (“Operator”) cost effective management platform. The three properties will be marketed for sale when the business plan has been achieved.

Extra Space Storage

Long Island, NY

RCP Long Island Self Storage invested into the ground-up development of a 664-unit, 100% climate-controlled, self-storage facility situated on 1.6 acres in Huntington, New York. Huntington is a fully developed suburb of Manhattan with significant barriers to entry and an under-supply of self-storage availability.

The 664 storage units will range from 25 to 300 square feet. The project has an estimated construction period of 14 months, followed by lease-up, stabilization, and is projected to sell after 42 months.

Winter Haven Gardens

Winter Haven, FL

RCP invested $6.93 million of equity capital to reposition a 330-room hotel complex. Upon acquisition, the property began a comprehensive renovation consisting of two phases.

The project will be converted into a 211-unit multi-family property consisting of 1- and 2-bedroom apartments. The project’s amenity plan will be built in the Phase I renovation. It will include a large central clubhouse, fitness center, game room, workstations and business center. The exterior renovations will include updating the swimming pool, and the addition of BBQ grills, a dog park and beach volleyball court.

The property is located in Winter Haven, Florida, equidistant from Tampa and Orlando. Winter Haven has been the second fastest growing major metropolitan area in the U.S. for the last two years, with strong market demand for multi-family properties.

Garden-Style Apartment Community

Houston, TX

RCP invested $5 million of equity capital to develop a Class A 336-unit garden-style multi-family apartment community. The Project is located on 13.25 acres in the Champions submarket of Houston, Texas.

The Project will be funded with approximately $37,930,000 of construction financing and $11,670,000 of preferred equity financing.

Kajani Capital Group serves as the sponsor/developer and will invest $875,000 of capital into the Project as the GP and $1,000,000 of family capital as LP equity.

Old Post Office Plaza Apartments

St. Louis, MO

RCP invested $5.6 million of equity capital to acquire an interest in an existing venture that owns two Class A apartment projects (The Tower & The Lofts at OPOP—Old Post Office Plaza) in the heart of downtown St. Louis, Missouri.

Built in 2014, The Tower at OPOP (pictured) is a 25-story, 128-unit luxury multi-family building. Redeveloped in 2014, The Lofts at OPOP is a historic seven-story, 53-unit luxury multi-family building that was the former Post-Dispatch Building and is on the National Register of Historic Places.

The Sponsor, Strategic Properties of North America (“SPNA”) has owned these two properties since 2017.

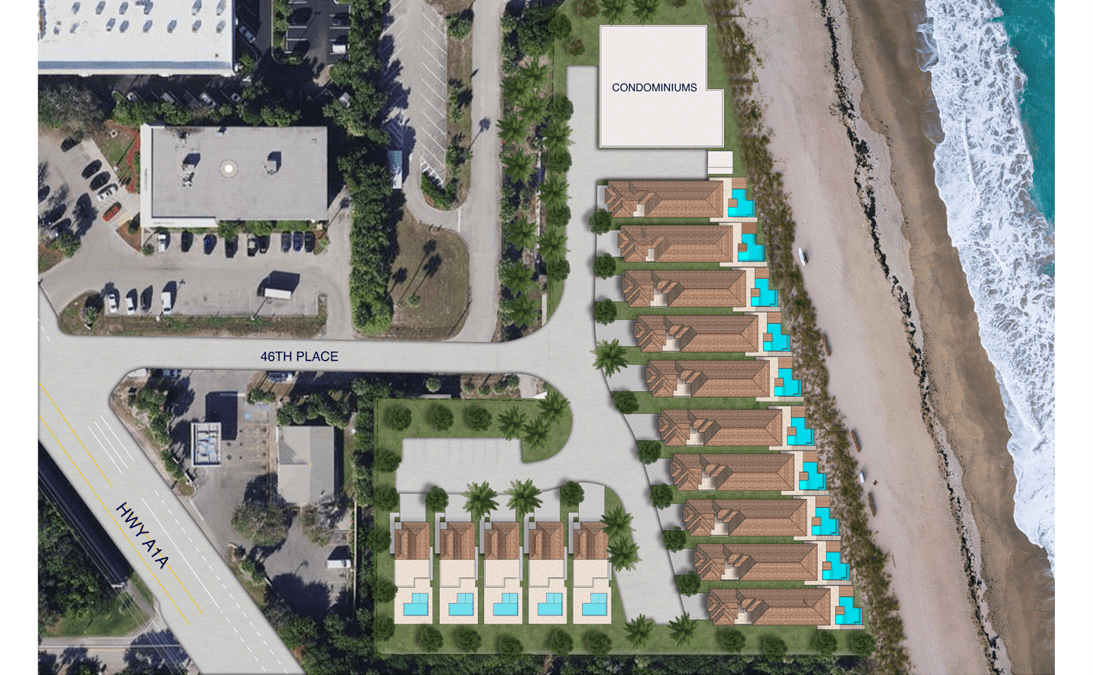

Indigo Vero Beach

Vero Beach, FL

RCP invested $4.7 million of equity capital to acquire an interest in a venture to construct ten ocean front single-family villas, five ocean view single-family villas, and six ocean front condominiums along 525’ and 4.56 acres of ocean front land in Vero Beach, Florida. This is one of the last significant ocean front sites remaining in Vero Beach.

The site was purchased for $6 million with an appraised value of $10.5 million. The developer had already received two separate offers to purchase the land for $13 million and $14 million. The beachfront single-family homes will have a very competitive price point starting at $3.2 million, which is rare for newly constructed ocean-front homes. Most new beachfront homes in Vero Beach list between $5 million to $10 million.

The sponsor/developer is providing a guaranty on the land and construction loan. It is anticipated all homes should be built and sold within 3 to 4 years.

Waterfront Residential Lot Development

Houston, TX

RCP invested into the development of a new residential community. The developer has been obtaining approvals for more than five years to dredge a 2,000’ long and 100’ wide canal to create this exclusive waterfront community allowing homeowners to dock their boats directly in front of their property.

The project is comprised of 105 residential lots on 37 acres located in League City, Texas. The property is on one of the last remaining undeveloped residential tracts on Clear Lake, the third largest boating community in the U.S. It is only a 30 minute drive to both Downtown Houston and Galveston beaches.

The project is located within a Municipal Utility District (MUD) and qualifies for $4.4 million in infrastructure development cost reimbursements upon completion. Of the 105 lots, 94 are under contract to be sold to Empire Homes. Empire is providing $2 million of non-refundable earnest money that will be used as equity to fund project development costs.

Turtle Creek Office

Dallas, TX

RCP invested into the value-add acquisition of two Class-B office buildings located in the highly desirable, Turtle Creek area of Dallas, Texas. Two buyers previously had the project under contract and eventually dropped out. The sponsor purchased the project for $2 million less than the original buyer due to COVID.

The Turtle Creek submarket, located just north of downtown Dallas, has been one of DFW’s strongest office submarkets for the last 10-15 years. Located only two blocks from the project is a recently announced Four Seasons Hotel and mixed development valued at $750 million.

The project is one of the last Uptown/Turtle Creek office asset to trade under $200 a square foot. There is currently strong demand from the small to medium sized business community for office space. The sponsor is planning to renovate both buildings, implement a spec suite program which should allow for a constant inventory. Upon stabilization, the project will be sold.

The Maverick Apartments

Dallas, TX

RCP invested in the acquisition and renovation of a 137-unit, 1970’s-vintage apartment complex in Dallas, Texas (“Project”). The Property is located minutes from the trendiest parts of Dallas – Oak Lawn, Medical District, Uptown, Downtown, Design District and Preston Center—all of which hold some of the largest employment locations in the metroplex. This property has direct visibility from the Dallas North Tollway at the Wycliff exit with exposure to more than 116,000 vehicles per day.

The immediate area has already been gentrified with the 2017 construction of The Lucas, a 387-unit Class “A” development directly across the street. 98% of the units are in “Classic” condition. The Project will undergo a heavy renovation of both the interior and exterior to completely reposition its marketability. The market has demonstrated it will pay more rent for a better product.

After the Project is acquired, renovated and stabilized, it should be sold in year three or four and provide investor cash-flow during the holding period.

Encore Crossings Apartments

Corpus Christi, TX

RCP invested in the acquisition and renovation of a 356-unit, apartment complex in Corpus Christi, Texas (“Project”). The Project is located on the south side of Corpus Christi near the city’s largest employers. The property is in a growing, upper income area of Corpus Christi. The average household income within 1-mile of the Project is $119,000 and the population has grown 223% since 2000.

The partnership intends to increase the value of the property by renovating the units and raising rates to a similar level to other comparable properties with similar finish out. The Project is capitalized with funds provided by RCP, equity provided by a third-party equity investor and equity sourced by the developer and an acquisition loan.

After the Project is acquired, renovated and stabilized, it should provide investor cash-flow before being sold.

Center Stage Land

Keller, TX

RCP invested in the acquisition of 38 acres of land in Keller, Texas, entitled for 475 apartment units, 57 single-family residential lots, and several commercial buildings. Entitled apartment land in Keller is extremely limited due to significant barriers to entry. Keller had not approved an apartment zoning case in 15 years before re-zoning this property.

The property zoning will include the largest number of multi-family units ever approved in the City of Keller. The multifamily land is already under contract to a national apartment developer with non-refundable earnest money and closing scheduled for late 2020.

The majority of the land should be sold in the first 12 to 18 months, which should more than pay off the debt and return equity to RCP Keller Land.

The Dylan

Fort Worth, TX

RCP funded a first-lien loan (“Acquisition Loan”) to acquire 23.5 acres of undeveloped land entitled for the development of up to 486 apartment units, located in Fort Worth, Texas (the “Project” or “Property”). The Acquisition Loan will accrue interest at a 12% compounded annual interest rate with a minimum of one year of earned interest. The Project is intended to be developed into the second and third phase of The Dylan, a 227-apartment community which is currently under construction. In addition to the first lien loan, RCP Dylan Land will also participate in its pro-rata share of a 25% profits interest in the Borrower. It is anticipated that the loan will be repaid with land sales proceeds.

Park Forest Offices and Storage Facility

Dallas, TX

RCP provided preferred equity to recapitalize and develop a four-acre site that includes an existing 66,199 square foot office building and a 368-unit Class “A” self-storage facility (the “Project”) that is under construction. The developer originally invested 100% of the equity into the project. After RCP’s preferred equity investment, the developer owns 44% of the invested equity. When RCP invested in the Project, the developer had owned the site for more than a year and was already well underway executing the business plan to demolish the one-story office building, renovate and consolidate tenants into the three story office building and then construct a new Class “A” 100% climate controlled, self-storage facility on the front half of the site.

The Project is the beneficiary of a limited supply of self-storage and prime demographics. The Project’s three-mile trade area is comprised of just two self-storage facilities which currently operate at 94% occupancy with no new storage facilities planned at the time of RCP’s investment. The Project is located in a densely populated section of Dallas with 245,000 residents living within a five-mile radius, offering a large market of office and self-storage users.

Lofts at Red Mountain

Glenwood Springs, CO

RCP invested in the development of the first phase of the Lofts at Red Mountain. Phase I consists of an 85-unit, two-building apartment complex in Glenwood Springs, Colorado (“Project”). The Project should benefit from the limited supply in the area caused by very high barriers to entry. There is an extreme shortage of rental housing in the Western Slope of Colorado. Meyers Research, an independent market research firm, concluded the current renter demand pool for market rate apartments consists of 5,750 qualifying households. This Project represents less than a 1.5% capture rate of the demand.

At the time of RCP’s investment, there were no market rate, Class AA multifamily housing development in the Roaring Fork Valley. Entitlements are very difficult to receive and there are very few buildable sites in the Roaring Fork Valley. The project is located in one of the premier buildable sites in Glenwood Springs, adjacent to a recently developed retail power center with a Target, Starbucks, Chili’s Grill & Bar, Petco and Bed, Bath & Beyond.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Hyatt Place Keystone

Keystone, CO

RCP invested in the acquisition and renovation of a 103-room hotel (The Inn at Keystone) in Keystone, Colorado. With the funds provided by RCP, along with a construction loan and preferred equity financing, RCP converted the hotel to a Hyatt Place. The Project has an excellent location along State Highway 6 in the heart of the Keystone Resort and is just a five-minute walk to a high speed chair lift that provides access to the entire Keystone mountain.

The Inn at Keystone is one of only three hotels in the entire Keystone area. Keystone is one of the closest ski resorts to a growing population of nearly five million people in Denver. Affiliating with Hyatt Hotels should improve occupancy and revenue and allow participation in Hyatt Gold Passport, one of the leading hotel loyalty programs. Hyatt affiliation should also increase the hotel’s sales value.

After the hotel is renovated and stabilized, it will be marketed for sale.

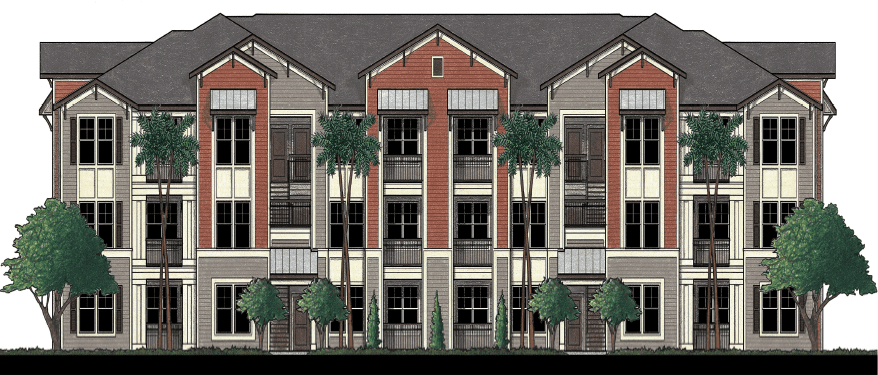

Switchyard Apartments

Carrollton, TX

RCP invested in the development of a 234-unit, four-story multifamily apartment complex in Carrollton, Texas (“Project”). The property is located directly across the street from historic downtown Carrollton. Downtown Carrollton boasts a variety of shops, restaurants and entertainment venues that provide a variety of activities for the surrounding area.

The Project is also located adjacent to a light rail commuter station which is governed by the Dallas Area Rapid Transit authority (DART). DART light rail averages 101,800 weekday riders or 26.5 million riders annually. The proximity of the Project to a light rail commuter station allows for it to be classified as a Transit Oriented Development which is coveted by some buyers during disposition.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Railyard Flats

Santa Fe, New Mexico

RCP invested in the development of a 58-unit multifamily apartment project in the urban core of Santa Fe, New Mexico. The project was developed on a 20,000 SF parcel under a long-term ground lease in the mixed-use Railyard District.

The Santa Fe apartment market had less than a 3% vacancy rate, this apartment project was the first new development in downtown Santa Fe in years as the market has significant local opposition to new development projects. The developer partner had already been working to secure the necessary entitlements for this project years before RCP’s involvement and only funded this project once the entitlements were received.

The project was completed on budget in about one year and upon opening was 100% leased at above pro-forma rental rates. The project cash flowed once it opened and was sold a year and a half later at a sales price that resulted in what was the highest price per apartment unit in the Santa Fe market.

The total investment lifetime was 2.3 years and sold in September 2019.

Iris Senior Memory Care of Rowlett

Rowlett, TX

RCP invested in the development of a 40-unit / 44-bed memory care facility located in Rowlett, Texas (the “Project”). The Project benefits from strong demand and limited competition. At the time of RCP’s investment, there was only one seniors housing facility which offered memory care units within a 5-mile radius of the proposed project. The occupancy rate of this competing facility was 96%. According to CBRE, one of the largest commercial real estate firms in the world, there was an undersupply of 171 memory care beds in the primary market area.

Rowlett has an average household income of $107,000, and the area surrounding the property reports household income in excess of $120,000. The Rowlett population grew 7% from 2010 to 2015 and was anticipated to grow an additional 4% over the next 5 years. Rowlett was ranked 24th on Money Magazine’s “Best Places to Live”.

After the Project is built, leased-up and stabilized, it will be marketed for sale.

Southlake Flex-Office/Industrial

Southlake, TX

RCP invested in the acquisition of an 18-building flex office/industrial portfolio (“Project” or “Portfolio”) in Southlake, Texas. The City of Southlake is a very affluent city that sits at the confluence of several major highways and less than two miles from Dallas/Ft. Worth International Airport. Southlake has the highest median income of any city in Texas.

The portfolio of assets was acquired out of foreclosure by the seller, who specializes in distressed transactions. While the seller realized a gain by bringing the property out of foreclosure, the Portfolio still had significant upside potential as RCP’s all-in cost basis was well below the Portfolio’s replacement cost. Furthermore, the Portfolio’s average rent was more than 20% below the average rental rate in Southlake for flex office/industrial space.

Cosmetic renovations, which included painting all of the buildings, adding contemporary architectural elements to some of the buildings, roof repairs and new landscape, were completed. The partnership renewed existing leases and signed new leases at higher rental rates and subsequently increased the income and value of the Project. The Project cash flowed immediately which allowed the partnership to make quarterly distributions to the investors. After a four-year hold period, the Portfolio was sold for a profit.

South 400 Apartments

Fort Worth, TX

RCP invested in the development of a 248-unit, three-story multifamily apartment complex in Grand Prairie, Texas (“Project”). Property is strategically located in the heart of the Dallas-Fort Worth Metroplex at the intersection of Texas State Highway 360 and Interstate 20. The site is one of the few remaining apartment sites in the I-20 corridor that has visibility on a major highway. Highway 360 has an average daily traffic count of over 90,000 vehicles and Interstate 20 has an average daily traffic count over 170,000.

Leading up to RCP’s investment, several positive economic development announcements were made which have helped the Project. Ikea announced it was building a 293,000 square foot store less than 3.5 miles from our Project which is estimated to generate more than 300 new jobs. This is only the second Ikea in North Texas. General Motors announced it would spend $1.4 billion to expand its plant which is 4.2 miles from the site and is estimated to generate 500 new jobs. The Epic, a $75 million water park, announced it would be built less than 5 miles from the Project and will kick-off the city’s Central Park development plan.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Gentry Park Senior Living

Bloomington, IL

RCP Bloomington Seniors Housing invested in the development of a 132-unit senior’s independent living, assisted living and memory care facility located on 17 acres in Bloomington, Indiana. The property enjoyed significant barriers-to-entry. Bloomington had a very limited number of developable sites that allowed for the development of seniors housing and had a very restrictive and lengthy entitlement process. At the time RCP invested in the project, the land was fully entitled for seniors housing development, which gave the project a significant “first-mover” advantage.

After construction was completed, the property provided its residents and their families with a comfortable, home-like environment within a state-of-the-art seniors housing facility. The property included the following amenities: exercise/therapy room, library, private dining room, movie room, spa, community pub, walking trails, an outdoor BBQ and picnic area with shuffleboard, and horseshoe pit.

RCP Bloomington Seniors Housing sold in February 2019.

Iris Senior Memory Care of Edmund

Oklahoma City, OK

RCP invested in the development of a 36-unit / 40-bed memory care facility located near Edmond, Oklahoma (the “Project”). At the time of RCP’s investment, the Edmond area demonstrated strong demand with an occupancy rate for memory care beds of 98% while the combined occupancy rate for assisted living and memory care was 95%. According to CBRE, one of the largest commercial real estate firms in the world, there was an undersupply of 148 memory care beds.

Edmond is an affluent Oklahoma City suburb with an average household income of $98,000. The two subdivisions located adjacent to the property have household income in excess of $125,000. The Edmond population has grown 15% since 2010 and was anticipated to grow an additional 10% over the next 5 years. Edmond was named by Forbes as one of the “Best 25 Suburbs to Retire” in 2015.

After the Project is built, leased-up and stabilized, it will be marketed for sale.

DoubleTree Suites by Hilton hotel

Sacramento-Rancho Cordova, CA

RCP invested in the acquisition and renovation of a 158-room Hyatt House hotel in Rancho Cordova, California, a suburb of Sacramento. The business plan called for the partnership to completely renovate and re-brand the hotel as a Doubletree Suites by Hilton within 12 months of acquisition.

The hotel was purchased at an extremely low basis. The owner acquired this hotel as part of a larger portfolio to be converted into a Hyatt House, an extended-stay concept. Because this hotel does not have many kitchenettes, which is a brand standard for Hyatt House, it would never be compatible with that brand. Subsequently, the owner did not want to generate attention with this sale and quietly negotiated an attractive sale price to get the hotel off its books.

At the time of RCP’s investment, Ranch Cordova was a strong and stable market. The upscale segment in the market, which includes the DoubleTree Suites concept, was experiencing a 74.7% occupancy and average daily rates (ADR) of $112.86. As a Hyatt House, the hotel was only achieving 68% occupancy and ADRs of $95. This confirmed there was significant upside potential to be realized from improved management and a major renovation.

Start Your Real Estate Investment Journey Today